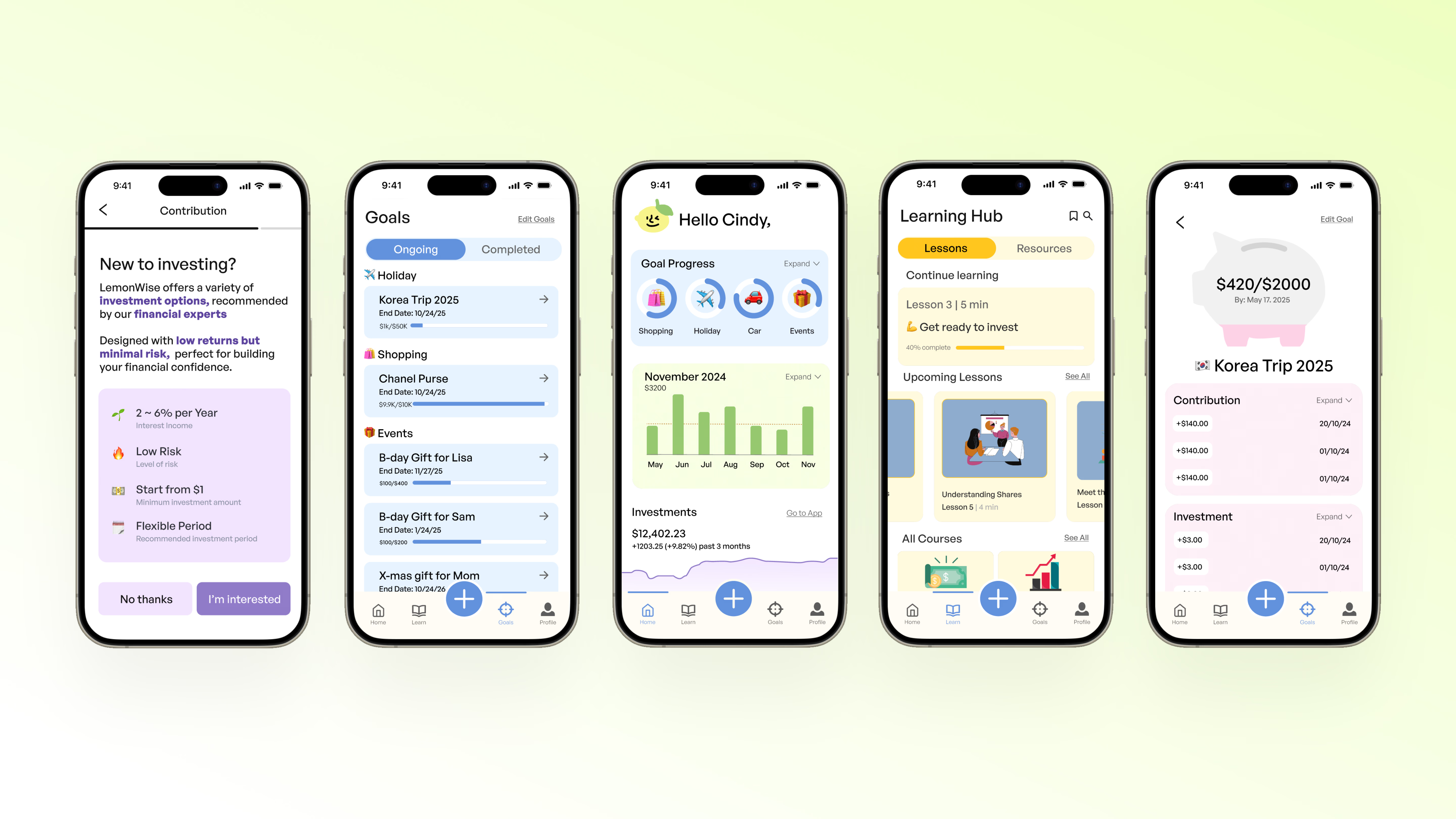

Lemonwise is a finance app designed to help new graduates develop financial literacy and healthy money habits. It combines a learning hub, goal-setting tools, and actionable investment opportunities to create an engaging and seamless experience for managing finances.

Helping new grads invest early so they can build financial literacy and nurture healthy money habits for long term success.

“I just graduated and I’m making my own money for the first time. What do I do now?!” 🤔

That's great! When life gives you lemons… make lemonade 🍋

We wanted to build a symbiotic relationship between the learning, investing, and the user's financial goals.

The learning hub equips users with essential financial knowledge, which they can immediately apply through the app's investing features. These investments, in turn, are tied to their personal financial goals, creating a continuous cycle of learning, application, and progress. This integrated approach ensures that users not only gain financial literacy but also see the tangible impact of their knowledge in achieving their goals.

Home Page

One-stop-shop for all your financial overviews

Gives users a general overview with widget-based summaries of their financial summaries and goal progress. Each section can be clicked on to redirect them to a more extensive section.

Spending Visualization

A no frills way of tracking spending data

Spending patterns and analytics are designed to be non-threatening and easy to understand.

Goal-Setting

Organization and goal-setting made simple

Users are guided through a smooth and intuitive onboarding process that makes setting long-term or short-term goals effortless, with clear prompts and visuals to keep them focused and confident.

Investment

Partnerships with external banking companies

Lemonwise is linked with external banking/investment apps so users can be redirected to the external apps if they want a more extensive view of their stocks

Investment

Improving education and transparency on investment terms

Rather than assuming users understand investment terms and setup, consistent onboarding is provided for all users.

Product tours and tooltips highlight unfamiliar terms and features.

Learning Hub

Quiz based modules in the learning hub

Modules that adapt and grow in complexity as users enhance their financial literacy to ensure continuous learning.

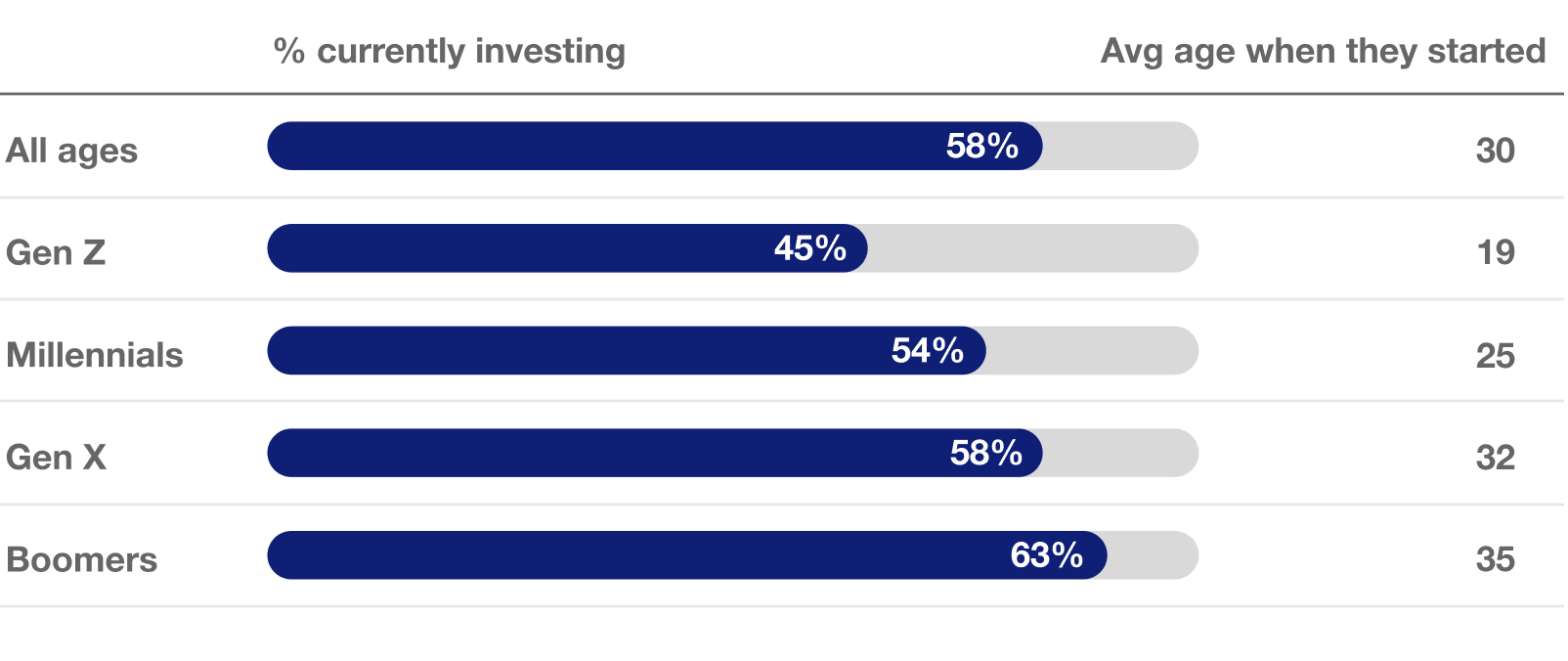

Gen Z adults began investing and saving at age 19 on average. This is significantly younger than Baby Boomers who began at an average age of 35 and Millennials at 25

Despite students and young people investing at an all time high 📈 basic financial literacy remains globally low 📉

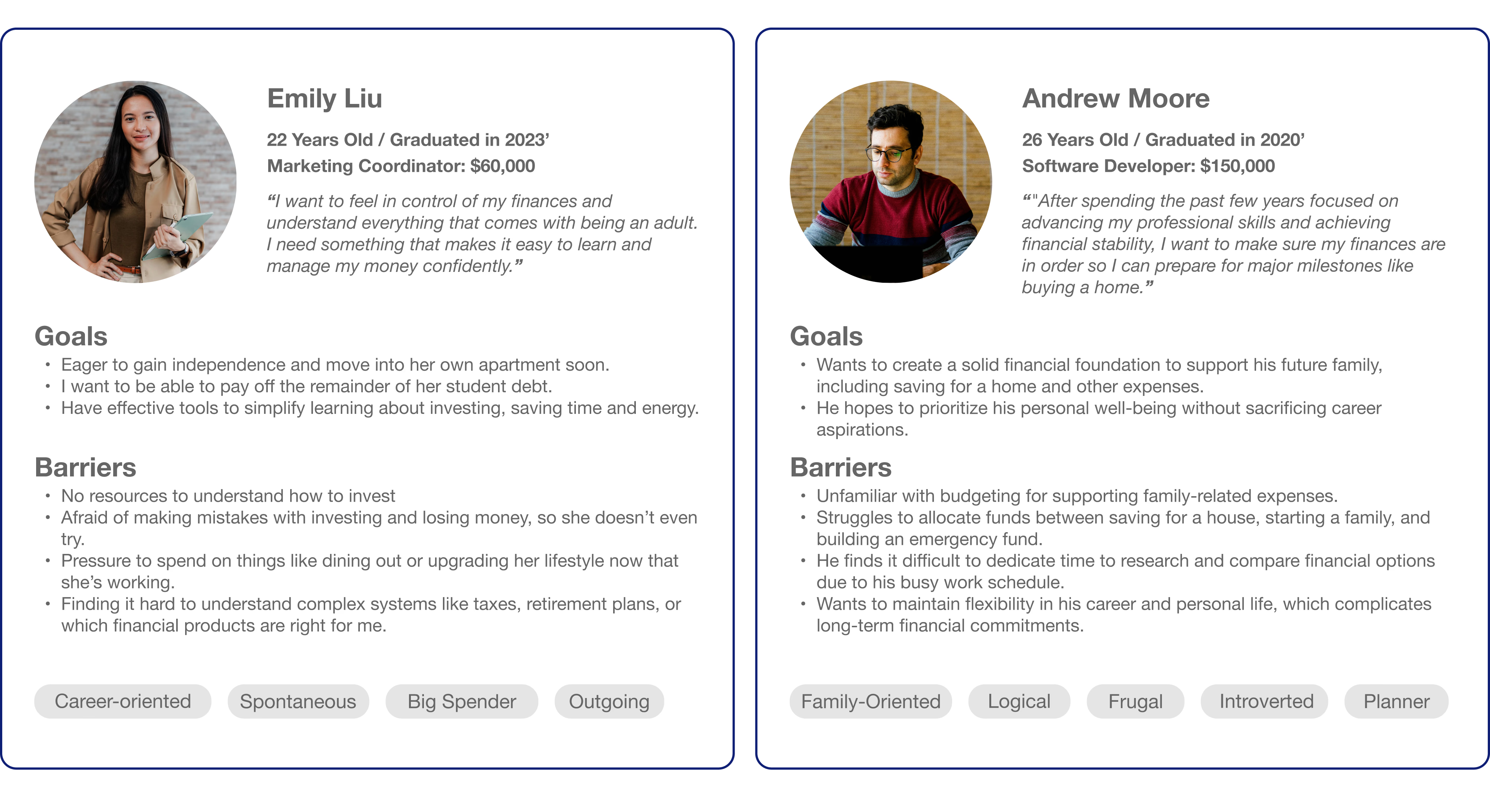

Interviews were conducted with eight new graduates, aged 21 to 26, including both employed and unemployed individuals

We wanted to understand how students, particularly those who are financially independent, manage their finances, and what resources or tools they currently use.

Interview Structure & Sample Questions:

01 Understanding Daily Financial Habits

"Can you tell me a little bit about your day-to-day spending habits?"

03 Evaluating Spending Awareness

"What would you do if you realized you were spending more than you had budgeted?"

04 Exploring Financial Goals

"Do you have any specific financial goals for the future? How are you planning to achieve them?"

Contextual Inquiry & Sample Questions:

01 Interface Walkthroughs

"Can you walk me through your thought process while navigating the current app you use?"

02 Reflections on Financial App Usage

"Which finance apps do you primarily use for managing your money, how effectively do they meet your needs?"

After interviewing 8 new grad students we learned that...

6/8 reported challenges in tracking spending, which led them to abandon budgeting practices.

6/8 is interested in investing but have no idea how to

5/8 participants mentioned a desire for better data visualization.

Based on our key findings and interviewees, we created two hypothetical users.

I began by leading the team in a brainstorming session where we wrote down every potential features the app could include. Each prompt was evaluated based on its impact and feasibility, allowing us to plot them on the prioritization matrix. This approach ensured that our design decisions were data-driven, focused on high-value features, and aligned with user needs and project goals.

After understanding our users, I was able to take our key findings to create a series of high-level goals which needed to be achieved.

Using the information architecture, I mapped out task flows to explore how a user would create a new goal, in this example, planning a budget for a holiday trip to Korea. I selected this task to identify the app’s MVP features and evaluate how seamlessly the process could incorporate the investing contributions aspect.

To jumpstart the design, I used the information gathered from our task flows to guide my design decisions for the initials wireframes.

We then conducted user flow testing with 6 different participants and documented all necessary adjustments to refine the design before moving into the final design.

Home page feedback + iteration

Goals page feedback + iteration

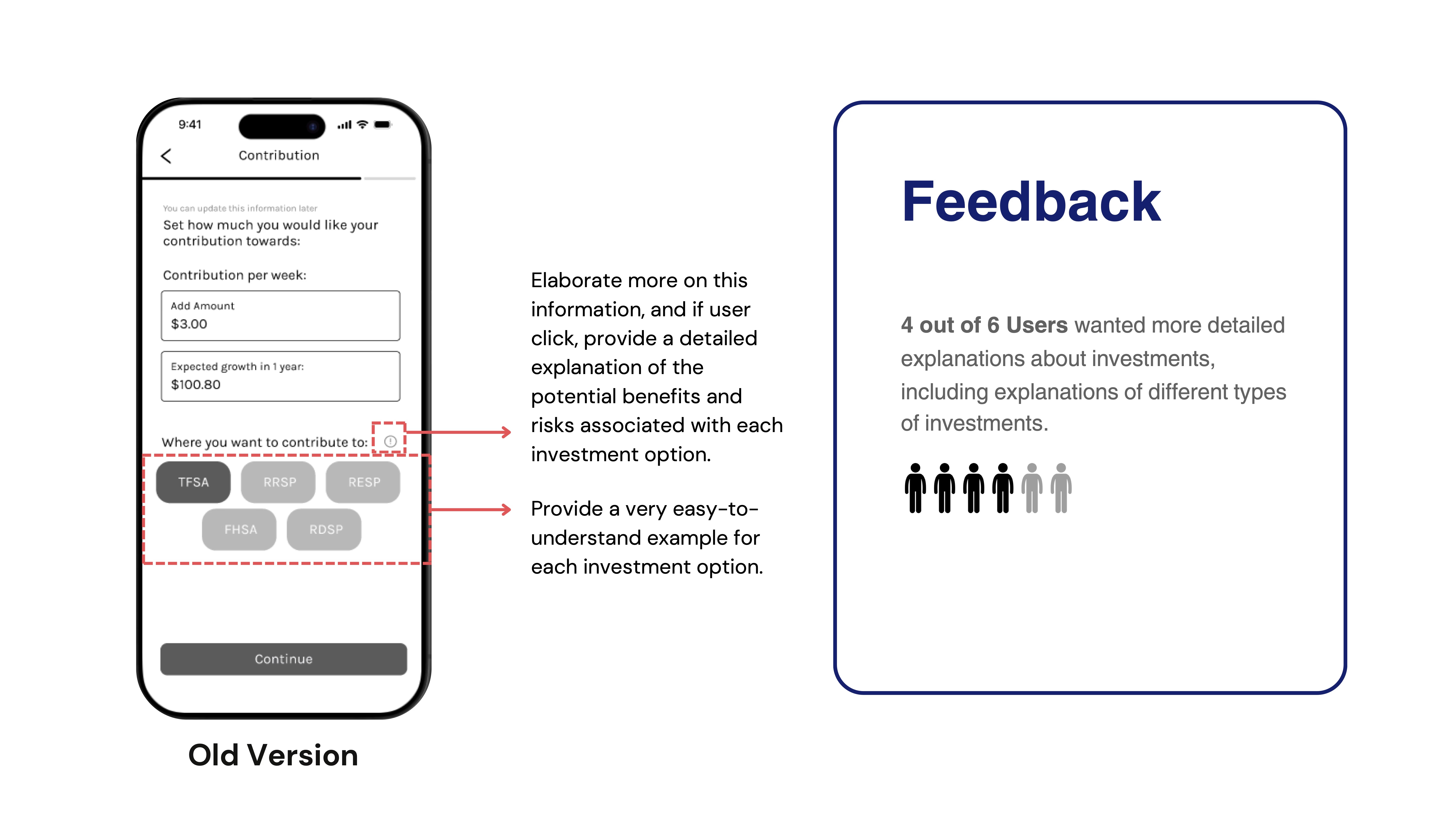

Investment onboarding feedback + iteration

We knew our target demographic were Gen-Z new grads therefore the design should use bright, vibrant colours with bold, modern typography and playful illustrations such as lemons and emojis.

I chose lemons as our theme, tying into the phrase "when life gives you lemons…" aligning with the concept of making lemonade, which our app represents taking control of one’s finances and turning small investments into financial growth.

Simplicity over Gimmicks

At first, our team wanted to include every possible feature for LemonWise, from real-time financial advisors to a social media component. However the core focus was always about making the app valuable for our target users. It’s not about adding every possible feature—sometimes the simplest, most practical tools are what stick. The goal is to create something that not only educates but keeps users coming back because it actually helps them.

Avoiding assumptions, prioritize understanding

Initially, we didn’t give much thought to the investment aspect—we assumed there wouldn’t be much interest. Once we started diving into the research, it was clear we were wrong. The lesson in this was stepping back and letting user feedback guide the process. It wasn’t easy admitting we’d missed something so obvious, but it taught me that in a field as personal and varied as finance, listening to your users isn’t just helpful—it’s essential.

I would like to explore implementing a rewards system to encourage users to engage with the learning hub. By offering incentives such as badges, milestones, or collaborating with local businesses offering them coupons for completing lessons, users would be more motivated to build their financial knowledge. This approach not only promotes consistent use of the learning hub but also reinforces the value of financial education in achieving their goals.